AMD and Nvidia's Fierce Competition in the AI Chip Market Heats Up

With the rise of generative AI technology, semiconductor giants Nvidia and AMD are locked in a fierce competition in the field of AI chips. Nvidia has seen a significant increase in market value due to strong demand for its GPU chips, but it also faces some potential concerns. Meanwhile, AMD is catching up with rapid growth in its AI chip sector.

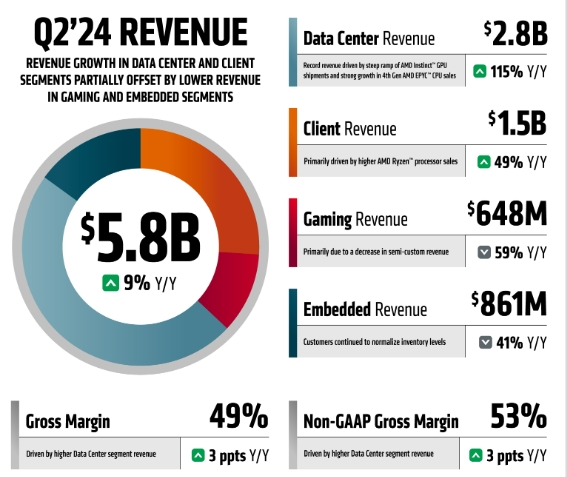

AMD's Better-Than-Expected Financial Report, Strong Data Center Business Performance

AMD's financial report for the second quarter, announced on July 31, shows a total revenue of $5.835 billion, a 9% increase year-on-year, with a net profit of $265 million, an increase of 881% year-on-year. Notably, the data center division's revenue hit a new high of $2.8 billion, a 115% increase year-on-year. AMD Chairman and CEO Dr. Lisa Su stated that the company will continue to accelerate development in the field of artificial intelligence and is expected to achieve strong revenue growth in the second half of the year.

Nvidia's Revenue Growth Exceeds 200% for Three Consecutive Quarters

Nvidia's financial report for the first quarter of fiscal year 2025 shows revenue of $26.044 billion, a 262% increase year-on-year, with a net profit of $14.881 billion, a 628% increase year-on-year. The significant growth in data center computing revenue is attributed to the increased shipments of Nvidia's Hopper GPU computing platform.

AMD and Nvidia's Product Roadmap

Both AMD and Nvidia have announced their product release cycles. AMD's MI325X AI chip is expected to be launched in the fourth quarter of 2024, while Nvidia's Blackwell super AI chip is planned to be released before the end of 2024. The industry generally believes that AMD's MI300 series chips are more competitive due to their open software optimization and higher configuration of high-bandwidth memory HBM3e.

AI Server Market Demand Outlook

According to TrendForce's survey, although Nvidia's market share in the AI server GPU market is close to 90%, AMD's market share is only about 8%. However, when considering all AI chips used in AI servers, including GPUs, ASICs, and FPGAs, Nvidia's market share is about 64%. It is expected that by 2025, with the launch of Nvidia's new Blackwell platform, there will be an increase in demand for technologies such as CoWoS and HBM.

Development of Cooling Technology

With the continuous growth in demand for AI servers, more effective cooling solutions are becoming increasingly important. It is expected that with the launch of Nvidia's new Blackwell platform, large cloud service providers will begin to build new data centers, and the penetration rate of liquid cooling solutions is expected to reach 10%.