Recently, Samsung, SK Hynix, and Micron released their latest quarterly financial reports, showing significant revenue and profit growth due to the rising demand for AI technologies. High-value products like High Bandwidth Memory (HBM) and DDR5 are expanding, drawing market attention.

Samsung's Q2 Financial Highlights

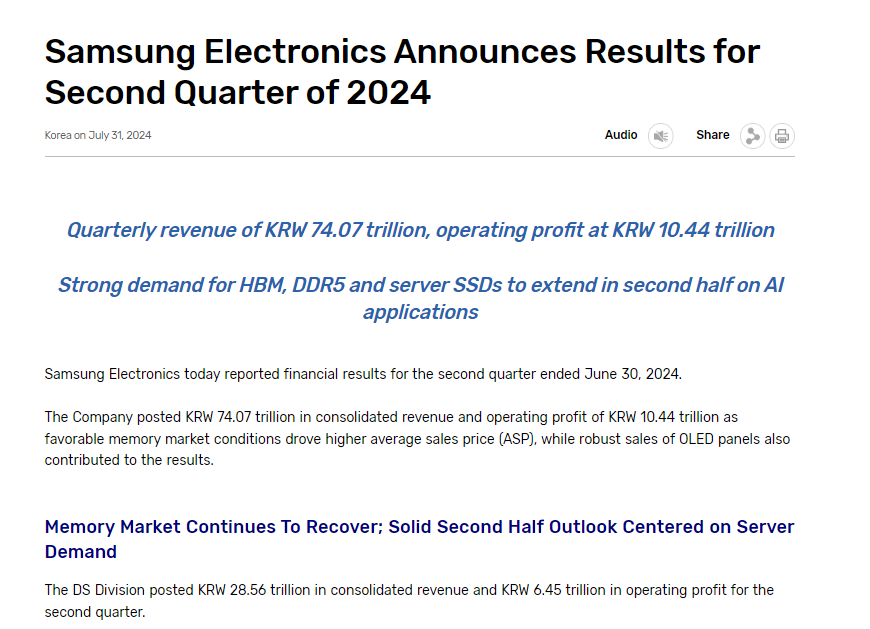

On July 31, 2024, Samsung Electronics announced its Q2 financial results, with sales reaching 74.07 trillion KRW (approximately RMB 3889.42 billion), a net profit of 9.64 trillion KRW (about RMB 506.2 billion), and an operating profit of 10.44 trillion KRW (about RMB 548.2 billion), marking a 471% year-on-year growth. The Device Solutions (DS) division, responsible for semiconductors, stood out with an operating profit of 6.45 trillion KRW (about RMB 338.69 billion).

The surge in performance is attributed to the generative AI boom, which has increased demand for high-value products like HBM and DDR5. Samsung expects strong demand for these products, along with SSDs, in the second half of 2024, and plans to expand its production capacity to boost HBM3E sales. The company is also focusing on high-density products, such as server modules based on 1b-nm 32Gb DDR5. In NAND, Samsung aims to strengthen sales of Triple-Level Cell (TLC) SSDs and meet customer needs for Quad-Level Cell (QLC) products optimized for various applications, including servers, PCs, and mobile devices.

Samsung's MX and network business reported combined Q2 revenue of 27.38 trillion KRW and an operating profit of 2.23 trillion KRW. Despite a seasonal decline in overall smartphone market demand, especially in the high-end segment, the Galaxy S24 series achieved double-digit year-on-year growth in shipments and revenue. Samsung anticipates overall smartphone demand to grow in the second half of 2024, driven by AI demand and innovative new products.

In the wafer foundry business, Samsung's revenue improved due to increased orders for sub-5nm technologies and a doubling of AI and high-performance computing (HPC) customers compared to last year. In 2024, the company expects growth exceeding the market average, driven by the mass production of second-generation 3nm GAA technology. Samsung has distributed 2nm GAA technology process development kits (PDK) to customers, aiming for mass production in 2025. The company plans to expand AI/HPC orders, targeting a fourfold increase in customers and a ninefold increase in sales by 2028 compared to 2023.

Industry sources indicate that to meet the AI-driven demand for memory chips, Samsung Electronics has decided to resume construction of its new Pyeongtaek (P5) plant, with completion expected by April 2027. The plant will initially produce NAND Flash, with the possibility of switching to DRAM depending on market needs. Recent supply chain news suggests Samsung's HBM3 memory chips have received NVIDIA certification.

SK Hynix's Financial Surge

On July 25, SK Hynix reported Q2 2024 revenue of 16.4233 trillion KRW, an operating profit of 5.4685 trillion KRW, and a net profit of 4.12 trillion KRW. The company's quarterly revenue hit a historic high, surpassing the previous record of 13.8110 trillion KRW in Q2 2022. Operating profit reached 5 trillion KRW for the first time in six years.

The growth is driven by strong demand for AI-related memory like HBM and eSSD, along with rising prices for DRAM and NAND flash products. The company's operating profit margin increased to 33%, with a net profit margin of 25%.

SK Hynix began mass production and supply of HBM3E and server DRAM in March 2024, leading to an 80% quarter-over-quarter and 250% year-over-year increase in HBM sales. NAND flash sales, particularly eSSD, continued to grow rapidly, with a 50% quarter-over-quarter increase.

The company forecasts strong demand for high-performance memory in the second half of 2024, driven by new PC and mobile products supporting edge AI. SK Hynix plans to start mass production of 12-layer HBM3E in Q3, maintaining its leadership in the HBM market. In DRAM, the company offers the highest capacity 256GB DDR5 DRAM for servers and aims to lead the NAND flash market with 60TB products.

SK Hynix is investing approximately $38.7 billion in a new advanced packaging and AI product R&D facility in Indiana, USA. The company's M15X plant in Cheongju, South Korea, has recently started construction, with mass production expected in the second half of next year. The Yongin Semiconductor Cluster is also progressing, with the first plant set to start construction in March 2025 and complete by May 2027. SK Hynix indicated that its 2024 capital expenditures might exceed the initial plan.

Micron's Financial Highlights

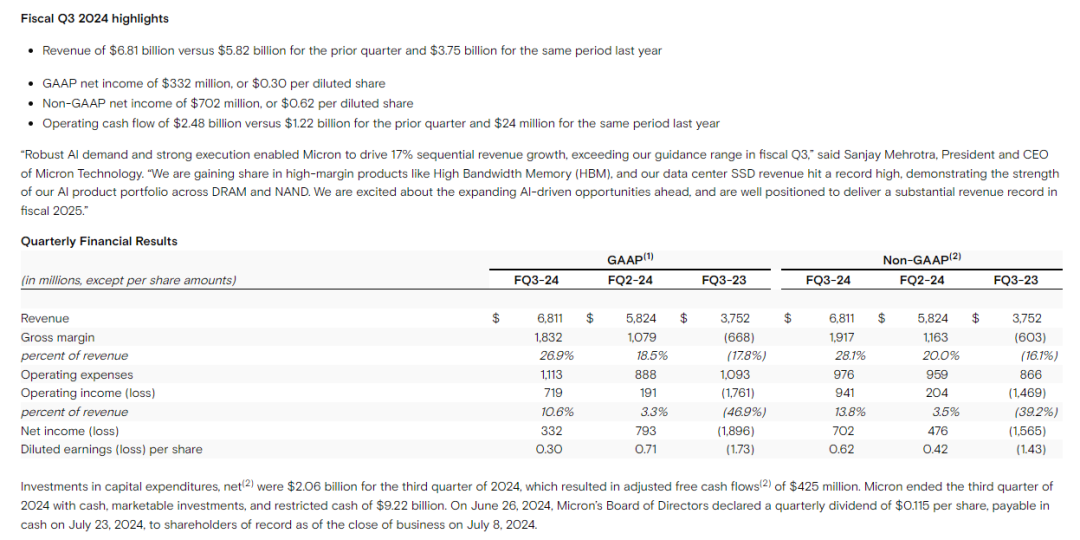

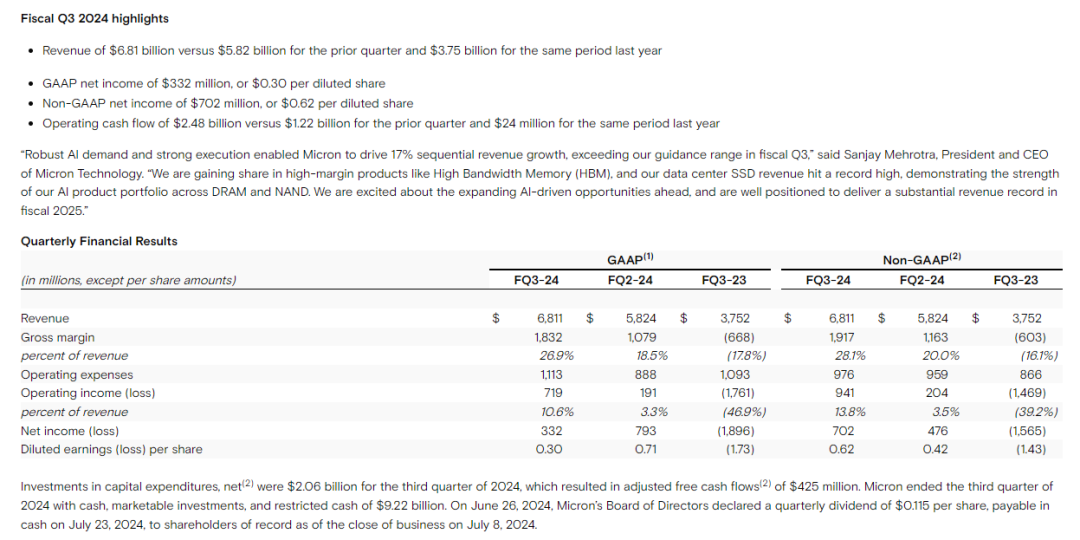

On June 26, Micron reported Q3 2024 revenue of $6.81 billion, an 81.6% year-over-year increase. The company's gross profit grew by 374.2% to $1.83 billion, with a net profit of $332 million, up 117.5% year-over-year. DRAM memory accounted for 71% of revenue, while NAND flash contributed 27%. Micron expects Q4 revenue to be between $7.4 billion and $7.8 billion, with an operating profit margin of 33.5% to 35.5%.

Micron emphasized the impact of AI on its business but acknowledged ongoing challenges in the smartphone and PC markets. Data center business grew by 50% quarter-over-quarter, and AI-related product prices are expected to rise.

Micron's collaboration with NVIDIA on AI GPU memory chips is strengthening, with the company's HBM business growing significantly. Micron anticipates that its HBM market share will match its DRAM market share, reaching 20-25% by 2025. The company's fifth-generation HBM3E revenue exceeded $100 million in Q3, with annual HBM revenue expected to reach "several billion dollars" in the next fiscal year.

To meet HBM demand, Micron has increased its 2024 capital expenditures to $8 billion, focusing on HBM production capacity. The company is considering converting its Malaysian plant to an HBM-dedicated production line and expanding HBM production at its Taichung plant in Taiwan. Micron's Hiroshima plant in Japan will also focus on HBM production, with capacity expected to reach 25,000 units by Q4. The company plans to introduce EUV processes and new cleanrooms to enhance production.

Market Trends and Challenges

HBM demand is expected to remain strong, but supply constraints and high costs pose challenges. Companies are exploring alternatives like LPDDR5X for high-bandwidth applications to balance performance and cost. AI and high-performance computing needs are growing, intensifying competition in the HBM market. Manufacturers are continually enhancing technology and production capabilities to meet these demands.